In today’s fast-paced digital world, everyone is looking for ways to generate passive income. Cryptocurrency staking has become one of the most reliable and rewarding methods to earn without active involvement. If you’re exploring how to earn passive income via staking SRP Token, you’re in the right place.

Staking SRP Token allows you to earn rewards simply by holding and delegating your tokens to the network. Whether you are a beginner or an experienced crypto investor, staking provides a smart way to make your digital assets work for you. Let’s dive into the details of staking and how you can leverage SRP Token to maximize your earnings.

What is Staking?

Staking is the process of locking up a certain amount of cryptocurrency in a blockchain network to support its operations, such as transaction validation and security. In return, participants earn staking rewards. Unlike traditional investments, staking doesn’t require active trading; instead, it provides a consistent stream of income over time.

Benefits of Staking

- Steady Passive Income: Earn regular rewards without active trading.

- Network Contribution: Helps in securing the blockchain.

- Lower Entry Barrier: Unlike mining, staking doesn’t require expensive hardware.

- Eco-Friendly: Uses less energy compared to mining-based mechanisms.

Why Choose SRP Token for Staking?

With numerous staking options available, SRP Token stands out as a strong choice due to its advanced blockchain infrastructure and secure staking mechanisms. Here are a few reasons why staking SRP Token is a great option:

- Integrated with DePIN Network: SRP Token is built within the DePIN ecosystem, ensuring enhanced security and scalability.

- High Potential Rewards: Competitive APY (Annual Percentage Yield) compared to other staking options.

- Strong Security Features: Advanced encryption and decentralized validation processes make staking SRP Token a safe option.

- Community Support & Growth: Backed by a strong community and ongoing developments.

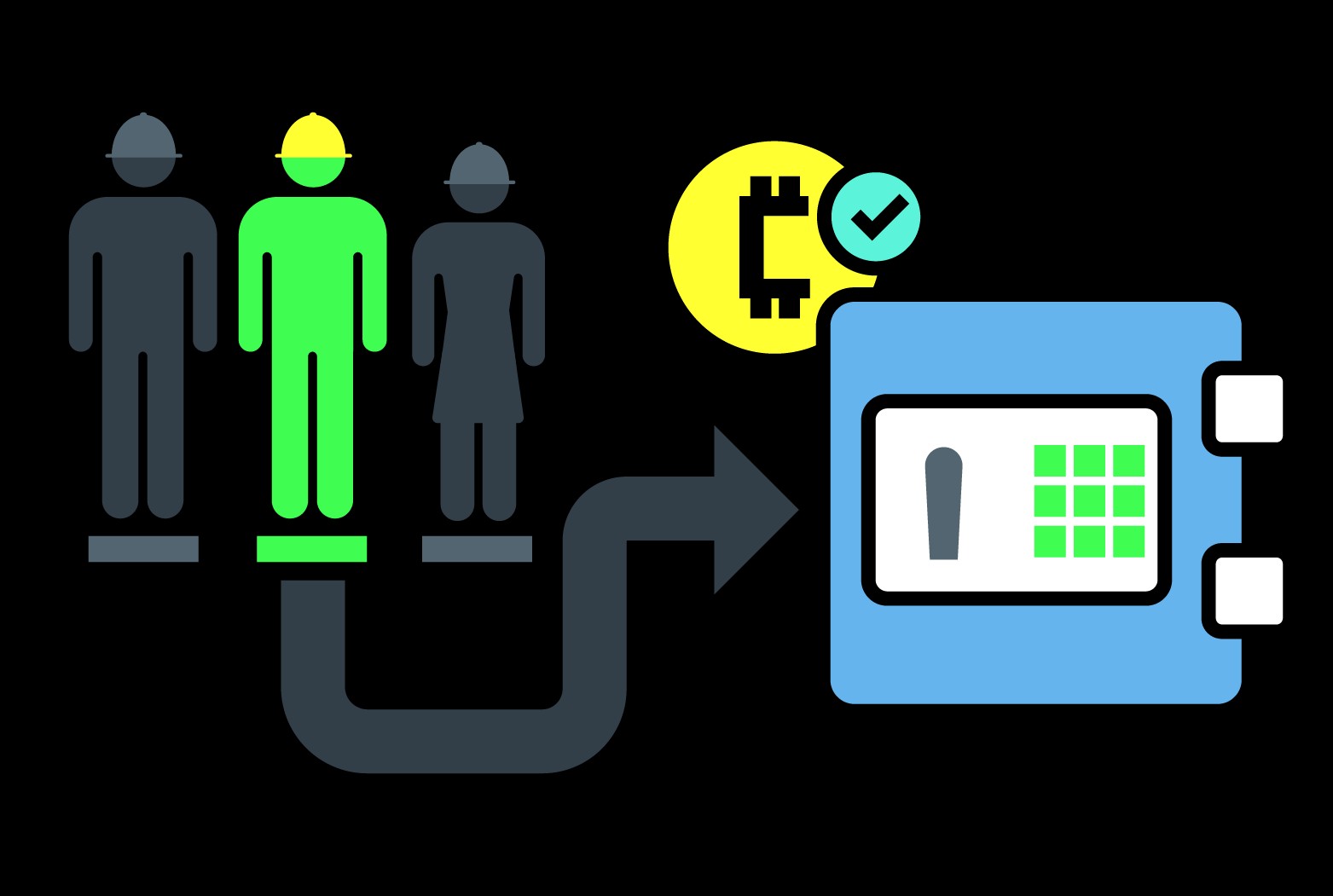

How Staking Works

Staking SRP Token follows a simple yet effective process. It involves holding your tokens in a compatible wallet and delegating them to a staking pool or validator to earn rewards.

Key Components of Staking

- Validators: Nodes that verify transactions and maintain network security.

- Delegators: Token holders who stake their SRP Tokens with a validator to earn rewards.

- Lock-up Period: The time during which staked tokens cannot be withdrawn.

- APY (Annual Percentage Yield): The estimated return on your staked tokens.

Now that you understand the basics, let’s go through the step-by-step process of staking SRP Token.

How to Start Staking SRP Token

1. Choose a Reliable Staking Platform

To start staking, you need a reliable platform that supports SRP Token staking. You can choose from:

- Official SRP Token Wallet

- Crypto Exchanges (if available)

- DeFi Staking Platforms

2. Set Up Your Wallet

A secure wallet is essential for staking. Some popular wallet options include:

- Hardware Wallets (Ledger, Trezor): Best for long-term security.

- Software Wallets (MetaMask, Trust Wallet): Convenient for easy access.

3. Buy and Transfer SRP Tokens

If you don’t already own SRP Tokens, you can purchase them from a cryptocurrency exchange. Once purchased, transfer them to your staking-compatible wallet.

4. Delegate or Stake Directly

- Delegating to a Staking Pool: Ideal for beginners as it requires less technical knowledge.

- Running Your Own Validator: More control but requires technical expertise and higher investment.

5. Monitor Your Earnings

Once you’ve staked your SRP Tokens, you can track your earnings using the staking dashboard provided by your chosen platform. Staking rewards are typically distributed at regular intervals.

How Much Can You Earn from Staking SRP Token?

The earnings from staking SRP Token depend on several factors:

- Staking Duration: Longer lock-up periods generally yield higher rewards.

- Total Tokens Staked: More tokens staked lead to higher earnings.

- Network Participation: The number of active stakers can influence rewards.

For example, if SRP Token offers an APY of 10%, staking 1000 SRP Tokens for a year would yield 100 SRP Tokens in passive income. The actual returns may vary based on network activity and reward distribution.

Risks and Considerations

While staking SRP Token is a great way to earn passive income, there are some risks to keep in mind:

- Lock-up Periods: During this time, you cannot withdraw or trade your staked tokens.

- Market Volatility: Cryptocurrency prices fluctuate, impacting the value of your rewards.

- Slashing Risks: If a validator misbehaves, staked tokens might be penalized.

- Platform Security: Always choose a trusted staking platform to avoid potential security breaches.

Tips to Maximize Your Staking Rewards

Want to optimize your staking returns? Here are some effective tips:

- Choose the Right Validator: Select a reliable validator with a good track record.

- Compound Your Rewards: Reinvest earned tokens to increase long-term returns.

- Diversify Staking Platforms: Spread your staking to reduce risks.

- Stay Updated: Keep an eye on SRP Token developments for potential upgrades and reward changes.

Conclusion

Staking SRP Token is an excellent way to earn passive income while contributing to the security of the blockchain network. With its strong ecosystem, secure staking options, and promising rewards, SRP Token presents a valuable opportunity for both beginners and experienced investors.

If you’re looking for a hands-off way to grow your crypto assets, staking SRP Token is a smart choice. Just ensure you follow the right steps, understand the risks, and use a trusted staking platform.

Now that you know how to earn passive income via staking SRP Token, are you ready to start staking?

China

China Russia

Russia India

India

3 Comments

먹튀검증사이트: chunjusa.org

The brand may be a satellite test for biometric-retail fusion systems in crypto economies.

weed gummies for anxiety relief calm